SL City Real Estate

We offer you many choices for living your best life in sustainable, convenient and enjoyable spaces

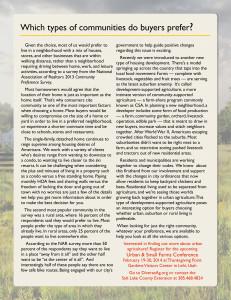

Solar Powered Marmalade Loft Townhouses

Brand new Townhouses in the Marmalade District Lofts, 1.5 blocks from the incoming library on 300 West. Read More

442 North Quince Street (160 West) in Salt Lake City 84103

Fondly referred to as “The Gingerbread House” by the neighbors, this three bedroom home exemplifies the architectural diversity of the beloved Marmalade district. Read More

The message is blowing in the wind, and shining on us daily.

My father came with me on a field trip to see the wind turbines at the mouth of Spanish Fork canyon. Read More

Oh the places you will go… on your bike

The Bicycle Advisory Committee comprises of 13 members and I’m one of them.

Forecast-sunny with a chance of growth

There were a variety of topics covered in the Utah Economic Forecast Event we attended today. Did you know we are in a position along the Wasatch Front to attract more jobs than California, surprisingly more so than the oh-so-booming San Francisco Bay area?

We have begun to “cluster”, clusters being geographic concentrations of interconnected companies (think technology related), specialized suppliers, service providers, and associated institutions that are present in our region. Clusters arise because they increase the productivity with which companies can compete. The development of clusters is vital part of the agenda for our local government, businesses and institutions, and driving the direction of Utah’s economic policy. This is manifested by the fact that the state has made it appealing for businesses to move here by reducing the costs of doing business in Utah. Having an affordable housing market available to workers is a bonus to the longterm sustainability of development. When you compare buying a home in San Francisco versus buying a home in Utah, it certainly is much more attainable goal.

2014 will be marked by a return to normalcy in the housing market in Utah, according to the speaker at the Forecast event James Wood, Director of the Bureau of Economic and Business Research at the University of Utah. Price increases are forecast to be moderate, in the 5-7% range, just a bit higher than the historic average of 4%, and sales of single-family homes will increase as improving economic conditions free up pent-up demand for housing. Additionally only 8% of mortgages in the state were underwater. Fewer negative equity mortgages allow homeowners, with mortgages previously underwater, to consider moving-up and they are.

Contact us for the most up to date information regarding the housing market in your community.